ElectriFI Annual Report 2024

Powering Access to Clean and Reliable Energy

This publication was produced with the financial support of the European Union. Its contents are the sole responsibility of EDFI MC and do not reflect the views of the European Union.

Introduction: ElectriFI - a Catalyst for Inclusion

Access to clean, reliable, and affordable energy remains a critical challenge on a global level, with millions still lacking access to basic power. ElectriFI is dedicated to tackling this challenge by providing strategic investments that accelerate sustainable electrification in emerging markets.

With 12 new investments, 2024 has been a record-breaking year with significant growth and impact for ElectriFI and EDFI Management Company. This annual report sheds light on ElectriFI’s achievements, presenting an overview of our investments and the impact that these investments have generated.

Since its inception, the ElectriFI Team had the privilege of witnessing the transformative impact of the off-grid energy sector. Through our investment mandates, we’ve supported 57 small and medium enterprises that are not just expanding energy access, but also driving technological innovation in agriculture, creating economic opportunities, and building climate resilience. With 78% of these ventures based in sub-Saharan Africa, and half involving equity participations, our strategy aims to meet the market’s needs and has provided us with a close-up look at its challenges.

We firmly believe that patient capital is crucial for the sector’s long-term growth. This conviction has shaped our investment strategy in recent years and will continue to do so in the future. It also underscores the significant additionality of the ElectriFI Facilities, as well as the need for similar initiatives.

Some of our investee companies successfully raised substantial amounts of additional capital with external investors, amongst which European DFI’s and/or their affiliates. This validates our strategy of providing early-stage catalytic financing to build and develop a portfolio of businesses until it is sufficiently mature to attract funding from DFI’s and other like-minded investors.

EDFI MC continues to allocate a significant part of its time to portfolio management, keeping the rigour of the monitoring while the portfolio keeps growing. Focus on cash management, liquidity position and cash runway showed important focus areas for both portfolio companies and new investment opportunities. We have also started to deploy the technical assistance to our investees, subject to availability of the TA budget in the relevant facility.

In the coming years, we want to build up on our lessons learned, and keep partnering with the EU Commission, local EUDs and governments and EDFIs on specific geographies to continue supporting access to electricity across geographies. We want to continue exploring new product offerings, innovative business models and our approaches to the sector of access to energy while pursuing to deepen the outreach and impact on the hundreds of millions still facing today very poor or no connection to energy.

We invite you to explore how our approach and strategic partnerships are powering progress across frontier markets, creating economic opportunities, and building climate resilience. Read on.

Background

Some of our investee companies successfully raised substantial amounts of additional capital with external investors, amongst which European DFI’s and/or their affiliates. This validates our strategy of providing early-stage catalytic financing to build and develop a portfolio of businesses until it is sufficiently mature to attract funding from DFI’s and other like-minded investors.

EDFI MC continues to allocate a significant part of its time to portfolio management, keeping the rigour of the monitoring while the portfolio keeps growing. Focus on cash management, liquidity position and cash runway showed important focus areas for both portfolio companies and new investment opportunities. We have also started to deploy the technical assistance to our investees, subject to availability of the TA budget in the relevant facility.

In the coming years, we want to build up on our lessons learned, and keep partnering with the EU Commission, local EUDs and governments and EDFIs on specific geographies to continue supporting access to electricity across geographies. We want to continue exploring new product offerings, innovative business models and our approaches to the sector of access to energy while pursuing to deepen the outreach and impact on the hundreds of millions still facing today very poor or no connection to energy.

We invite you to explore how our approach and strategic partnerships are powering progress across frontier markets, creating economic opportunities, and building climate resilience. Read on.

ElectriFI contributes to Global Gateway, the EU’s investment strategy for partner countries, which aims to mobilise EUR300 billion in investments between 2021 and 2027 with a mix of grants, concessional loans and guarantees to de-risk private sector investments.

Global Gateway is the European strategy to boost smart, clean and secure connections in digital, energy and transport sectors, and to strengthen health, education and research systems across the world.

Global Gateway is fully aligned with the UN’s Agenda 2030 and its Sustainable Development Goals, as well as the Paris Agreement. Global Gateway aims to mobilise up to EUR300 billion in investments.

Through a ‘Team Europe approach’, Global Gateway will bring together the EU, its Member States and their financial and development institutions to mobilise the private sector

ElectriFI mandates

ElectriFI is composed of four facilities:

2015

Global Facility

2017

Country Windows I

2020

Country Windows II

2022

Mozambique

Country Window

All implemented by EDFI Management Company on behalf of FMO.

ElectriFI facilities are funded by the European Union, while additional contributions from Power Africa, Sweden and Italy only concern the Global Facility.

ElectriFI’s 2024 at a Glance

Investments

Access to clean, reliable and affordable energy is a matter of convenience but it is also a fundamental driver of economic growth and social empowerment. In 2024, our commitment translated into tangible impacts across multiple continents, with a focus on sub-Saharan Africa.

Our investment of EUR 26.5m, supporting 12 innovative companies (plus two additional companies we provided with additional development finance loans), demonstrates the power of targeted investments in the energy sector across Africa and beyond.

2024 marked a year of diversification and innovation in our investment approach. Beyond traditional renewable energy generation and distribution, we ventured into clean cooking with a Development Finance Loan to Emerging Cooking Solutions (followed by a convertible note investment in Q1 2025) and e-mobility with BodaWerk. These investments represent our commitment to addressing energy poverty holistically and aligning with global trends towards sustainable living and transportation.

CPP - Captive Power Plants

Indirect Fund

IPP - Independent Power Producers

Minigrid

Other

SHS - Solar Home System

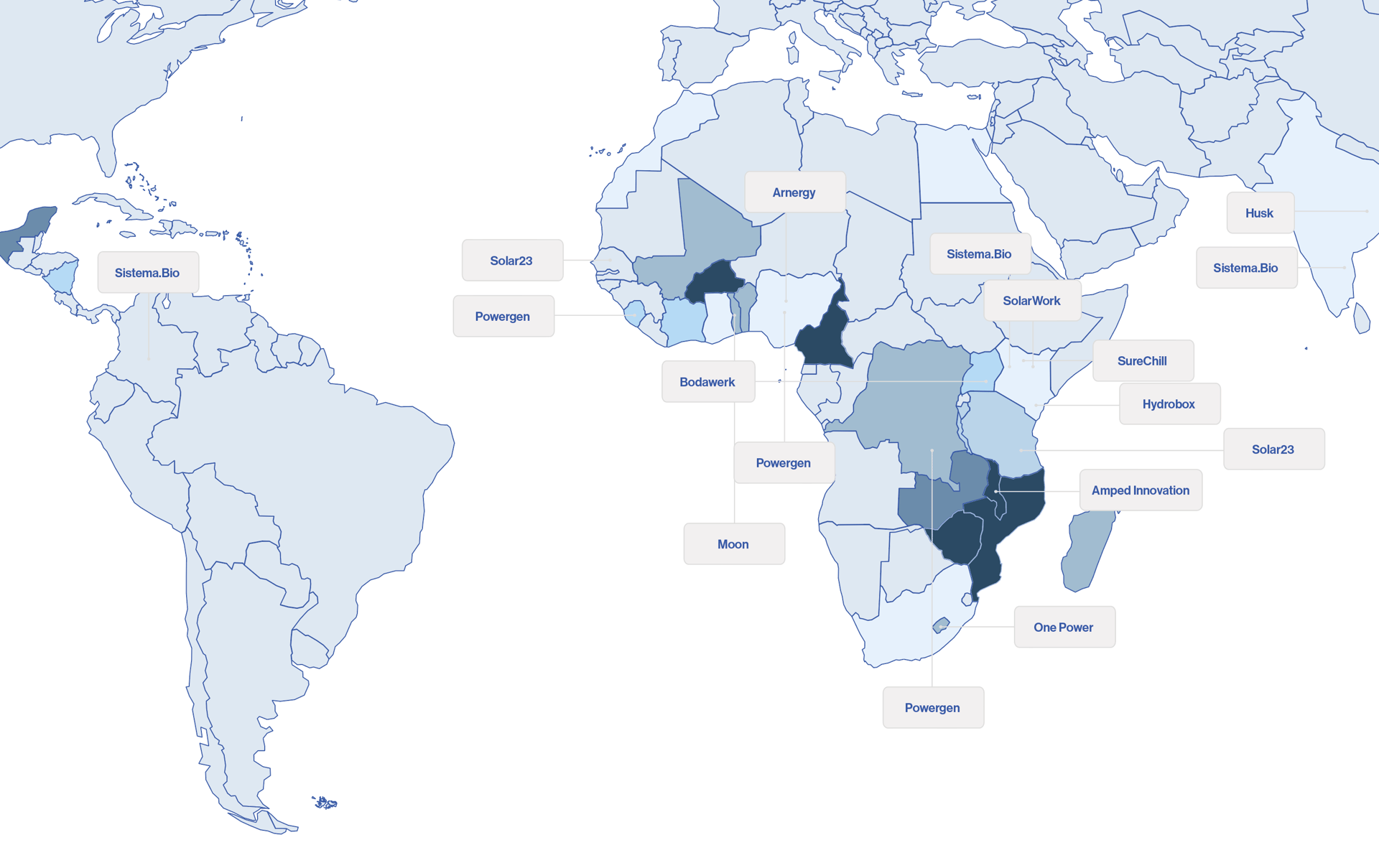

- Solar Panda - Kenya

- Husk - India

- Amped Innovation - Malawi

- Bodawerk - Uganda

- Sistema.Bio - India, Kenya, Mexico

- One Power - Lesotho

- SureChill - Kenya

- hydrobox - Kenya

- Solar23 - Burundi, Senegal

- Powergen - Nigeria, Sierra Leone, Congo, DRC

- Moon - Togo

- Arnergy - Nigeria

Portfolio Overview

The ElectriFI portfolio demonstrates a diverse and impactful investment strategy, comprising 77 distinct investments across 57 different investee companies. These companies benefit from one or more long-term investments, showcasing our commitment to sustained support for innovative energy solutions. The total investment amount reaches EUR 153.9m, reflecting the significant scale of our financial backing to the off-grid energy sector in emerging markets.

57

Different investee companies

€153.9m

Total investment amount

Our investment strategy focuses heavily on sub-Saharan Africa, with 78% of our ventures located in this region. Half of our investments involve equity participations, reflecting our commitment to providing patient capital and aligning our interests with those of the companies we support. This approach brings valuable insights into the challenges faced by businesses operating in these emerging economies and it has allowed us to meet the unique needs of the market. By maintaining such close involvement, we are better positioned to understand and address the obstacles to sustainable energy access in the region.

The largest exposure of ElectriFI is with the Solar Home System business model, with 29.3% of the total committed capital. Proportion of minigrids continues to increase, with 29% of the total commitments. The category “Other” comprises companies active in distributed renewable energy (SunCulture, Sistema.Bio or MyJouleBox) or in the e-mobility sector (Bodawerk).

ElectriFI’s investments in equity and quasi-equity instruments represent 50.3% of the total commitments and underscore our strategy to provide highly catalytic capital in the decentralized renewable energy sector.

ElectriFI’s Investment Approach: Emphasizing Equity for Long-term Impact

This approach is crucial for two key reasons:

1. Equity investments play a vital role in unlocking the growth potential of energy companies, particularly in emerging markets:

Patient Capital: Equity provides companies with long-term, patient capital without the burden of immediate debt repayments. This allows early-stage energy companies to focus on growth and innovation rather than short-term financial obligations.

Alignment of Interests: Equity provides companies with long-term, patient capital without the burden of immediate debt repayments. This allows early-stage energy companies to focus on growth and innovation rather than short-term financial obligations.

Flexibility for Early-Stage Companies: Equity financing offers the flexibility needed by early-stage companies operating in high-risk environments with unpredictable revenues.

Strategic Support: Beyond capital, equity investments often come with strategic guidance, industry expertise, and valuable networks tha can accelerate a company’s growth.

2. ElectriFI’s investments have a proven catalytic effect, not only mobilizing significant additional funding but also building a track record that makes companies “bankable” for EDFIs and other investors:

Leverage Factor: With EUR 150m invested directly leveraging EUR 530m in additional funding, ElectriFI has achieved a leverage factor of 4.4x-demonstrating its ability to attract substantial private and institutional capital.

De-risking and Track Record Building: By providing early-stage, high-risk capital, ElectriFI helps de-risk companies and projects, establishing a performance history and credibility that lowers barriers for subsequent investors, including EDFIs and commercial financiers.

Market Development: ElectriFI’s investments are instrumental in developing and scaling renewable energy markets, with 40% of its portfolio co-invested alongside other Development Finance Institutions-further validating investee companies.

Additionality: Every investment is rigorously assessed for additionality, ensuring ElectriFI’s support is enabling projects that would otherwise struggle to attract funding.

By building a pipeline of investable, “bankable” companies and leveraging its catalytic effect, ElectriFI is accelerating the development of clean energy access in emerging markets-laying the groundwork for future investment, economic growth, and environmental sustainability.

Impact

ElectriFI”s investments are designed to make a substantial impact on the sustainable energy landscape. Through our investments to date, ElectriFI has contributed to the generation of 674,512 MWh of clean electricity annually, a significant step towards sustainable energy transition in regions where it’s needed the most. By avoiding almost 2,413,607 tonnes of CO2 equivalent emissions per year, we’re helping powering homes and businesses while contributing to global climate action. Finally, the reach of our portfolio investments extends to 26.4 million beneficiaries, illustrating the real-world impact on communities and individuals.

Beneficiaries

26,443,426

Beneficiaries

GHG Avoided

26,443,426

Tons CO2/year (eq)

Energy produced

674,512

MWh/year

Leverage

For every euro invested, we mobilized an additional EUR 3.4 of DFI or private investment. This leverage factor showcases our role as a catalyst for broader financial engagement in the sector.

€530m

Mobilised

4.4X

Leverage factor

Mini-Grids: Catalysing Rural Electrification in Africa

Mini-grids are a promising solution for rural electrification in Africa and other developing regions, offering several key advantages. They can be deployed much more rapidly than extending the main grid to remote areas, providing electricity access to rural and isolated communities that would otherwise be difficult or uneconomical to connect. For many remote areas, mini-grids offer a more cost-effective electrification option compared to grid extension. These systems can be tailored to local energy needs and demand, optimizing resource use and often incorporating renewable energy sources like solar power. Mini-grids also contribute to local empowerment by creating jobs and economic opportunities within the communities they serve. They provide more consistent power than an unreliable central grid in some areas, enhancing energy security.

Additionally, mini-grid systems are often scalable, allowing for expansion as energy demand grows in a community. These factors combined make mini-grids an attractive and practical solution for accelerating rural electrification efforts across Africa and beyond, helping to bridge the energy access gap in a sustainable and efficient manner.

We have been at the forefront of this movement, strategically investing in companies like PowerGen, OnePower, Husk Power Systems, WeLight and Les Soleils du Bénin to accelerate the deployment of mini-grids across the continent.

Here are some examples of investments that reflect our commitment to scaling up mini-grid solutions in Africa.

- PowerGen: PowerGen has been recognized for its work in Kenya, Nigeria, Sierra Leone, and Tanzania. After our first investment of USD 2m in 2020, we signed an additional USD 5m in 2024.

- OnePower: ElectriFI’s investment in the Sotho Minigrid Portfolio, operated by OnePower Lesotho, amounts to EUR 6m and aims at expanding electricity access in rural Lesotho.

- Husk Power Systems: ElectriFI initially invested USD 6m in Husk in 2022, for their activities in India, followed by an additional USD 4m in 2024, demonstrating confidence in the company’s business model and impact potential. Husk is also active in Nigeria.

Mini-grids are increasingly recognized as a critical component in achieving universal energy access:

- Scale of Impact: The World Bank estimates that mini-grids could provide electricity to 111 million households by 2030, requiring an investment of USD128 billion.

- Cost-Effectiveness: By 2030, mini-grids could produce electricity at costs as low as USD 0.20/kWh, making them the least-cost solution for over 60% of the population in some African countries.

- Rapid Deployment: The number of installed mini-grids in Sub-Sahran Africa has grown from around 500 in 2010 to over 3,000 today, with 9,000 more planned for development.

- Renewable Energy Integration: Between 2018 and 2024, the share of solar PV in mini-grids increased from 14% to 59%, contributing signif cantly to clean energy adoption.

Husk Power Systems

Founded in 2007, Husk Power Systems exemplifies the transformative potential of mini-grids in rural electrification.

Key Achievements:

- Husk has achieved over 400 operational mini-grids, with 2,500 km of transmission and distribution network.

- The company has expanded its operations in both India and Nigeria, demonstrating the scalability of its model across different markets.

- Husk initially focused on biomass-based mini-grids in India but has since expanded to include solar hybrid systems, providing reliable electricity to rural communities.

Impact:

- By 2024, Husk has directly impacted 1.5 million people across its o erational areas.

- The company now provides reliable electricity to more than 30,000 micro, small, and medium-sized enterprises (MSMEs).

- Husk’s initiatives have led to the avoidance of 15,000 tonnes of CO2 emissions annually, displacing about 3,000 diesel generators.

OnePower Lesotho

With a mission to deliver affordable and reliable electricity to off-grid communities, particularly in challenging terrains, OnePower Lesotho has pioneered a unique approach to mini-grid development in Lesotho, showcasing its ability to adapt and thrive in complex environments.

Key Achievements:

- Developed Lesotho’s first solar-battery mini-grid in the village of Ha Makebe, Berea district.

- Secured concessions for 11 mini-grid sites across rural Lesotho, with a total planned capacity of 1.8 MW.

- Implemented innovative technologies, including locally manufactured PV trackers, optimized for Lesotho’s mountainous terrain.

Impact:

- By end of 2025, OnePower’s projects are set to provide first-time electricity access to over 32,800 beneficiaries. Moving forward and beyond 2025, One Power will increase the impact, connecting another 7,300 beneficiaries.

- The company’s mini-grids will serve approximately 9,100 households, 68 schools, 20 clinics, and 470 SMEs across rural Lesotho.

- OnePower’s approach has enabled a competitive tariff of USD 0.33/kWh (5 Maluti per kWh), making electricity more affordable for rural communities.

Innovative Approach:

1. Portfolio Model: Rather than developing each mini-grid in isolation, OnePower bundles construction and operation into an efficient portfolio approach, optimizing resources and reducing costs.

2. Local Manufacturing: The company designs and manufactures PV trackers in sub-Saharan Africa, promoting local industry and reducing costs.

3. Community Engagement: OnePower’s projects are developed with strong community participation, ensuring local buy-in and sustainability.

Funding and Support:

OnePower’s success has been bolstered by strategic investments and partnerships:

- Received initial support from ElectriFI with a EUR 100,000 development finance loan in 2018.

- Secured EUR 4.4m investment from ElectriFI in December 2021.

- And additional EUR 2m investment from ElectriFI in September 2024, demonstrating continued confidence in the model.

Future Outlook:

OnePower’s success in Lesotho serves as a model for rural electrification in challenging terrains. The company’s innovative approach, combining technological innovation with community engagement and a portfolio model, offers a scalable solution for expanding energy access across Africa.

Future Outlook for Mini-Grid Investments

The future of mini-grid investments in Africa appears increasingly promising, with several key trends and initiatives driving growth:

1. Technological Advancements: The declining costs of mini-grid components, including PV modules, inverters, batteries, and smart meters, have significantly enhanced the financial viability of mini-grid projects.

2. Policy Support: Several governments are tailoring regulatory processes for different mini-grid scales to enhance flexibility and reduce costs. Countries like Ethiopia, Kenya, Nigeria, Tanzania, and Zambia have implemented cost recovery tariffs using cost-based

formulas.

3. Rapid Growth: The number of mini-grid installations has grown six times since 2018, with solar PV systems increasing from 14% to 59% of total capacity between 2018 and 2024.

Mini-grids are poised to play a pivotal role in Africa’s energy future, offering a scalable and sustainable solution to the continent’s electrification challenges. With continued investment, technological innovation, and supportive policies, mini-grids have the potential to significantly contribute to achieving universal energy access across Africa.

Solar Home System Solutions: Democratizing Energy Access

ElectriFI’s investments in companies active in the solar home systems (SHS) and related technologies are playing a significant role in democratizing energy access across Africa. By supporting companies like Solar Panda, Moon Togo and RDG Collective, ElectriFI is driving the expansion of affordable and clean energy solutions to underserved communities.

ElectriFI’s Investments in Solar Home Systems

ElectriFI has made significant investments in companies providing solar home systems:

1. Solar Panda: ElectriFI committed USD 4m to Solar Panda in 2022, enabling the company to expand its reach in Kenya. In 2024, ElectriFI confirmed its commitment to the company by providing an additional USD 2m equity investment.

2. Moon Togo: ElectriFI invested EUR 2m in Moon Togo in 2024, supporting the company’s mission to expand access to clean, affordable energy across Togo.

3. RDG Collective: ElectriFI invested a EUR 2m convertible note in RDG Collective in 2022, supporting the company’s efforts to provide Solar Home Systems and Productive Use Appliances in rural Zambia.

While the potential for solar solutions is immense, the off-grid solar market in Africa could reach USD 24 billion annually, several challenges exist:

1. Initial Costs: The upfront cost of solar installations remains a barrier for many households.

2. Credit Risk: providing payment solutions to end-customers is a risky business.

3. Geographic Variations: Solar intensity varies by location, affecting system efficiency.

Fortunately, these challenges have been endorsed by the sector and opportunities have arisen:

1. Innovative Financing: Pay-as-you-go models and microfinancing are making solar more accessible. Investee companies like Solar Panda, RDG or Vitalite have been using and improved this payment scheme over the past years.

2. Lessons learned over the last years have enabled SHS companies to improve their credit scoring at onboarding and customer relationships over the repayment period.

3. Technological Advancements: Improvements in battery technology and smart energy management software are enhancing system efficiency.

ElectriFI’s investments in solar home systems are catalysing a revolution in energy access across Africa. By supporting the sector, ElectriFI is providing clean and affordable energy, which is driving economic empowerment and environmental sustainability. As technology advances and innovative financing models emerge, the potential for scaling these solutions and truly democratizing energy access in Africa is immense.

Solar Panda

Solar Panda serves as a prime example of the significant impact of solar home systems in Africa:

- Customer Base: As of July 2024, Solar Panda has served over 350,000 families in Kenya, with more than 30,000 in underserved counties.

Impact:

- The company’s SHS systems will provide access to clean energy to additional 620,000 households and act and mitigate the negative effects of climate change by avoiding 110,000 additional tonnes of CO2 eq.

Moon Togo

Moon Togo showcases the potential of innovative energy solutions in Africa, highlighting their role in enhancing energy access and improving quality of life for communities:

- Expansion: With ElectriF’s investment, Moon aims to triple its connected households from 20,000 to 60,000 across 15 new prefectures in Togo.

- Innovative Model: Moon operates a unique community-based model, hiring local members and providing long-term employment contracts.

- Government Partnership: Moon operates under the Togolese government’s CIZO program, which supports the deployment of solar photovoltaic kits.

- Environmental Impact: Moon manages the repair and collection of end-of-life products for recycling with a local Togolese partner.

Impact:

- By end of 2028, Moon is set to provide first-time electricity access to over 200,000 beneficiaries, and avoid additional 2100 tons of CO2 eq.

- The company is set to generate a total of 265,000kWh/yr if renewable energy.

RDG Collective

RDG Collective demonstrates the impact of solar home systems in Zambia, showcasing how innovative financing models and strategic support can enhance energy access and economic opportunities:

- Market Reach: RDG aims to distribute more than 50,000 new SHS over six years, resulting in 174,000t CO2 emissions avoidance.

- Product Range: The company offers solar home systems, refrigerators, solar water pumps, and smartphones on a pay-as-you-go basis.

- Economic Impact: Customers report generating additional income and improving their quality of life through RDG’s products.

- Rapid Approval: Customers can apply for and be approved for a PAYGo product loan within 15 minutes.

- Technical Assistance and Partnership: In 2022, EDFI Management Company invested USD 2 million in RDG through a convertible note via ElectriFI. Building on this partnership, EDFI MC is providing technical assistance to strengthen RDG’s financial management capabilities, funded by the European Union, to help RDG achieve its ambitious growth plans and expand clean energy access in Zambia and Southern Africa. This collaboration underscores the importance of strategic partnerships in enhancing the financial sustainability and operational efficiency of companies like RDG, ultimately contributing to increased access to clean energy solutions in the region.

Solar home systems are significantly enhancing energy accessibility and affordability. Customers are benefiting from cost savings by replacing expensive kerosene, phone charging, and battery costs with more affordable solar solutions. Additionally, these systems provide extended lighting hours, allowing families to enjoy better study and work conditions. Many customers also use solar products for income-generating activities, such as offering phone charging services or extending shop hours, which further boosts their economic prospects.

Impact:

- The company is expected to provide first-time electricity access to over 270,000 beneficiaries, avoid more than 170,000 tons of CO2 eq and generate 15,900 MWh/yr by 2028.

Diversifying Impact: Clean Cooking,

E-Mobility and beyond

ElectriFI’s strategic diversification into clean cooking and e-mobility sectors demonstrates its commitment to addressing energy challenges and environmental concerns across Africa. By supporting companies like Emerging Cooking Solutions (trading under the name of Supamoto) and Bodawerk (trading under the name of GOGO Electric), ElectriFI is driving innovation in sustainable energy solutions.

In 2024 ElectriFI has expanded its investment portfolio to include:

Clean Cooking: Development Finance Loan in Emerging Cooking Solutions (ECS) Supamoto, focusing on affordable and sustainable cooking solutions in Zambia to be followed by an investment in the next period:

- Reduces deforestation and indoor air pollution

- Creates a sustainable fuel value chain, generating jobs

- Lowers cooking costs for households

- E-Mobility: A USD 1.6 million investment in GOGO Electric, supporting e-mobility initiatives in Uganda:

- Reduces greenhouse gas emissions and air pollution in urban areas

- Improves income for motorcycle taxi drivers through lower operating costs

- Promotes local manufacturing and job creation in the green economy

These sectors show significant impact, they contribute to multiple UN Sustainable Development Goals, including affordable and clean energy, climate action, and economic growth.

As these projects scale up, they have the potential to transform energy access and environmental sustainability across Africa with an immediate effect. ElectriFI’s investments in these sectors demonstrate our approach to addressing both energy poverty and climate change simultaneously.

GOGO Electric’s E-Mobility Initiative

GOGO Electric, established in Uganda in 2017, is pioneering advancements in the

e-mobility sector:

- Local Manufacturing: The company locally manufactures electric batteries, converts and assembles electric motorcycles, and offers battery swapping services.

- Innovative Approach: GOGO Electric is establishing Africa’s first semi-automated Lithium-Ion battery factory, with a capacity of up to 60,000 batteries per year.

- ElectriFI Investment: The USD 1.6 million revolving working capital facility from ElectriFI will be used for sourcing battery components and assembling e-motorcycle batteries.

- Impact: The investment is expected to create local jobs in manufacturing and after-sales services, improve drivers’ revenue and working conditions, and reduce air pollution.

Impact:

- The company is expected to successfully deploy its business model and reach more than 8500 clients. Switching to EV systems will have a robust impact in decarbonising urban areas and avoid up to 57,000 tons of CO2 eq.

ECS Supamoto’s Clean Cooking Solution

Emerging Cooking Solutions (ECS) Supamoto is making a significant impact on cooking practices in Zambia, introducing new solutions:

- Innovative Product: ECS manufactures clean-burning stoves and pellets made from sawdust, a waste product from Zambia’s sustainable timber plantations.

- Affordability: The pellets cost substantially less than charcoal, making clean cooking more accessible.

- Efficiency: A new stove design, fine-tuned remotely with sensor data, achieved the highest efficiency and lowest emissions ever recorded in biomass stove tests.

- Funding: ECS is seeking to finance 7,500 specially developed microgasification stoves and launch a new IoT stove, which will reduce fuel procurement costs by 30%.

Impact:

- The company is expected to reach 27,600 households, proving them with clean cooking solutions which will have multiple health, livelihood, economic and social benefits for its customers.

- By the end of 2027, ECS will hire more than 300 full-time employees, most of them women.

Looking Ahead

As we look towards 2025 and beyond, ElectriFI is poised to play a pivotal role in Africa’s renewable energy landscape.

ElectriFI’s strategy will focus on:

- Accelerating Mini-Grid Investments: Building on our successful partnerships with companies like Husk, PowerGen and OnePower, we aim to expand our mini-grid portfolio to reach more underserved communities.

- Scaling Solar Solutions: We will continue to support innovative solar companies, focusing on those that provide affordable and accessible energy to rural and peri-urban areas.

- Further Diversifying into innovative solutions like for Clean Cooking and E-Mobility: Following our support of ECS Supamoto and investment in Bodawerk, we plan to increase our support for clean cooking solutions and e-mobility initiatives and focus on innovative solutions like green hydrogen and energy storage advancements.

- Catalysing Private Investment: Our goal is to further leverage our investments, aiming to mobilize even more private and DFI capital for every euro invested by ElectriFI.

Contact Details

EDFI Management company

Rue du Trône 4,

1000 Brussels

info@edfimc.eu

www.edfimc.eu

ElectriFI Annual Report 2024

Powering Access to Clean and Reliable Energy