AgriFI Annual Report 2024

Staying on Course in Stormy Weather

This publication was produced with the financial support of the European Union. Its contents are the sole responsibility of EDFI MC and do not reflect the views of the European Union.

Table of contents

Investing in Agriculture

Access to finance for smallholders and agri-SMEs remains a critical challenge globally, with millions of farmers struggling to increase yields and incomes sustainably and improve their and their children’s lives. AgriFI’s mission is to address this challenge head-on, driving inclusive and sustainable agricultural growth across frontier markets.

This annual report highlights our achievements in 2024, presenting an overview of all our investments, the impact we’ve made, challenges faced, and future goals. We invite you to explore how our approach and strategic partnerships are cultivating progress across frontier markets, creating economic opportunities, and building climate resilience in the agricultural sector.

From our strategic investments to our expansion into new country windows, 2024 has been a year of significant growth and impact for AgriFI and EDFI Management Company, and the main funder the European Union. Our EUR 120 million facility has continued to support investments that focus on smallholder inclusiveness and agri-businesses, addressing crucial gaps in agricultural financing.

As climate change intensifies, bringing more frequent droughts and floods, the agricultural sector faces unprecedented challenges. AgriFI’s investments, supporting climate-resilient farming practices, sustainable supply chains, and increased yields, directly impact some of the most vulnerable populations, helping to raise farmer incomes and improve food security.

With a leverage ratio of 3.05X, having mobilized an additional EUR 108.5 million in investments, AgriFI demonstrates its catalytic role in the sector. Our patient capital approach, focusing on medium to long-term financing, is creating lasting impact in vital agricultural value chains across the developing world.

AgriFI is funded by the EU and managed by EDFI Management Company. The initiative prioritizes investments that focus on smallholder inclusiveness, support increased yields, help raise farmer incomes, promote high environmental and social standards, and strengthen sustainable supply chains.

Background

The Agriculture Financing Initiative (AgriFI) is a specialized investment facility managed by EDFI Management Company (EDFI MC) and funded by the European Union. AgriFI was created to address the critical financing needs in the agricultural sector across developing regions. Its primary mandate is to invest in smallholder-inclusive agribusinesses and agricultural MSMEs, focusing on sustainable and climate-resilient agricultural practices.

AgriFI prioritizes investments that have high development impact but face challenges in securing commercial financing. These challenges often stem from factors such as limited collateral, perceived high risk in agricultural ventures, or the relatively small size of agribusiness.

AgriFI’s mission is to support sustainable agricultural market development in low and lower middle-income countries, contributing to several Sustainable Development Goals, particularly those related to poverty reduction, food security, and climate action. It achieves this by enabling European Development Finance Institutions and private sector investors to increase the scale and impact of their work in the agricultural sector, especially in higher-risk opportunities.

Key challenges addressed by AgriFI include:

- Bridging the financing gap for smallholder farmers and agribusiness MSMEs

- Mitigating risks associated with agricultural investments in developing regions

- Promoting adherence to high environmental and social standards in agriculture

- Strengthening sustainable agricultural supply chains

- Catalysing additional private sector participation in sustainable agriculture initiatives

AgriFI contributes to Global Gateway, the EU’s investment strategy for partner countries, which aims to mobilise EUR 300 billion in investments between 2021 and 2027 with a mix of grants, concessional loans and guarantees to de-risk private sector investments.

Global Gateway is the European strategy to boost smart, clean and secure connections in digital, energy and transport sectors, and to strengthen health, education and research systems across the world.

Global Gateway is fully aligned with the UN’s Agenda 2030 and its Sustainable Development Goals, as well as the Paris Agreement.

Through a ‘Team Europe approach’, Global Gateway will bring together the EU, its Member States and their financial and development institutions to mobilise the private sector to leverage investments for a transformational impact.

AgriFI mandates

ElectriFI is composed of four facilities:

AgriFI Global

A EUR 40 million facility providing medium- to long term financing for private sector enterprises active in the agri food value chain across countries listed in the OECD DAC list.

€40m

AgriFI-Ghana Country Window

A EUR 10 million facility supporting the modernization of Ghanaian agri-food systems in the five northern regions and beyond, focusing on seven high potential crops.

€10m

AgriFI-Tanzania Country Window

A EUR 12 million facility tailored by the EU Delegation to focus on nationally important value chains such as tea, coffee, and horticulture.

€12m

AgriFI-Sri Lanka Window

An EUR 8 million facility supporting the agriculture sector, with a focus on organic agriculture, cold chain development, and food processing to reduce food waste and post-harvest losses.

€8m

AgriFI-ACP Regional Window:

A EUR 50 million facility providing long-term financing to exemplary projects in member countries of the Organisation of African, Caribbean and Pacific States (OACPS), emphasizing women and youth participation in agricultural transformation.

€50m

All these facilities are implemented by EDFI Management Company on behalf of FMO.

AgriFI investment mandate is flexible. As a blending instrument, it is meant to leverage private and DFIs funding by using public funds. As a patient capital provider, typical tenors range between 5-7 years. Despite working on a commercial basis, AgriFI has no minimum return target. It is an “impact first” facility.

With total commitments of EUR 52.7 million and a leverage ratio of 3.05X, AgriFI has mobilized an additional EUR 108.5 million in investments, demonstrating its catalytic role in the agricultural sector. The initiative aims to address financing gaps until the market reaches critical mass and private sector players can step in more readily.

AgriFI’s 2024 at a Glance

In 2024, AgriFI continued its mission to support sustainable agricultural development across developing regions. Our investments this year demonstrate our commitment to addressing critical challenges in the sector, focusing on smallholder inclusiveness and agribusiness MSMEs.

Total investment in 2024

€11. 3 million

4 out of 5 in fragile countries

According to the OECD 2025 report1 which presents Malawi, Zambia and Tanzania (with 2 investments in 2024) into the OECD multidimensional fragility framework.

Number of investments

5 companies supported in 2024

Investment Breakdown:

- Direct investments: 2 investments

- Indirect investments: 3 investments

Financial Instruments:

- Senior Debt: 4 investments

- Equity: 1 investment

2024 confirmed our continued efforts in diversifying portfolio, spanning various segments of the agricultural value chain:

- Microfinance: Supporting smallholder farmers through AMZ - Agora Microfinance in Zambia to foster resilience to climate shocks and bridging the access to finance gap for smallholder farmers.

- Food Processing: Investing in EA FOODS LIMITED FO to increase its outreach to Zanzibar

- Banking: Partnering with NBS Bank in Malawi to improve financial access for agricultural businesses and smallholder associations.

- Rural Development: Supporting Sarvodaya in Sri Lanka to finance agro leasing.

- Organic Farming: Investing in Zanj Spices - 1001 Organic in Tanzania, promoting sustainable agricultural practices and reducing deforestation.

1 OECD (2025), States of Fragility 2025, OECD Publishing, Paris, https://doi.org/10.1787/81982370- en.

Portfolio Overview

AgriFI’s portfolio demonstrates a diverse and impactful investment strategy, comprising 21 distinct investments across 19 different investee companies. These companies benefit from one or more long-term investments, showcasing our commitment to sustained support for innovative agricultural solutions. The total commitments reach EUR 52.7 million, reflecting the significant scale of our financial backing to the agricultural sector in developing regions. Our total commitments increase by 26% versus previous year.

21

Distinct investments

19

Different investee companies

€52.7m

Total commitment

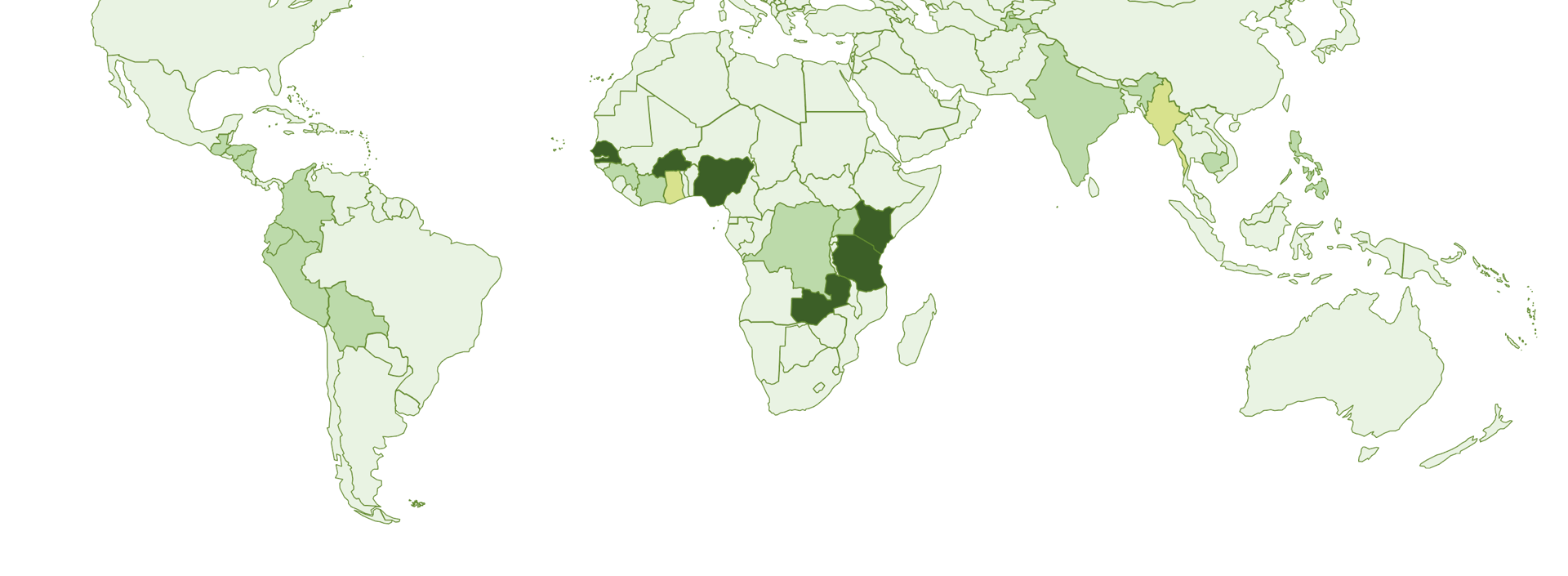

Our investment strategy spans multiple geographies, with a strong focus on Africa. In 2024, 80% of our investments were made in countries labelled as “fragile” by the OECD. This confirms AgriFI strategy to be a long-term investor despite climate or macro-related shocks. This geographical diversity allows us to address a wide range of agricultural challenges but also seize opportunities across different markets often neglected by traditional investors.

Direct

Indirect MFI

Indirect fund

AgriFI’s investments are strategically distributed across various financial instruments and business models:

- Financial Instruments: Our portfolio includes a mix of senior debt (59%), equity (14%), and junior debt (27%) investments. This diverse approach allows us to provide tailored financial solutions that best meet the needs of our investee companies and maximize our leverage. This diverse approach allows us to provide tailored financial solutions that best meet the needs of our investee companies and maximize our leverage.

Business Models: We support a range of agricultural businesses, including:

- Direct investments in agribusinesses (46%)

- Indirect investments through funds (26%)

- Finance institutions (28%)

This diversified approach enables us to support various segments of the agricultural value chain, from smallholder farmers to larger agribusinesses.

AgriFI’s Investment Approach: Catalysing Agricultural Development

AgriFI’s strategic focus on providing debt and equity investments underscores its commitment to offering flexible, catalytic capital in the agricultural sector. This approach is crucial for two key reasons:

1. Tailored Financial Solutions:

Patient Capital: Our diverse financial instruments offer the flexibility needed by companies operating in high-risk environments with unpredictable revenues. This concretely translates into a flexible approach towards collaterals and/or Sustainability-Linked Loans.

Patient Capital: Equity provides companies with long-term, patient capital without the burden of immediate debt repayments. This allows early-stage energy companies to focus on growth and innovation rather than short-term financial obligations.

Alignment of Interests: By taking equity stakes or providing subordinated debt, AgriFI aligns its interests with those of the existing shareholders, building stronger partnerships and shared long-term goals.

Strategic Support: Beyond capital, our investments often come with strategic guidance, industry expertise, technical assistance and valuable networks that can accelerate a company’s growth.

2. AgriFI’s Catalytic Effect:

Leverage Factor: AgriFI has achieved an overall leverage ratio of 3.05X, meaning that for every euro invested, an additional EUR 2.05 of investment has been mobilized by other sources.

Risk Mitigation and Bankability: By providing early-stage, high-risk capital, AgriFI helps de-risk agricultural projects and companies, making them more attractive and “bankable” for EDFIs and other institutional investors. Through our support, companies are able to establish a performance history and credibility, lowering the perceived risk for subsequent investors and paving the way for larger-scale funding.

Market Development: Our investments contribute to building and accelerating sustainable agricultural markets across developing regions by fulfilling unmet funding needs and creating a pipeline of investable businesses for the broader development finance community.

Additionality: All investments are assessed through strict additionality criteria, ensuring that AgriFI’s capital enables projects that would otherwise struggle to secure funding or got delayed.

By catalyzing private and institutional capital and building a track record for investee companies, AgriFI is actively creating the conditions for EDFIs and other investors to invest with greater confidence and less risk, thereby accelerating the transformation and sustainability of agricultural markets in developing regions

Impact

At portfolio level, investments have yielded significant results across multiple Sustainable Development Goals (SDGs):

- SDG 1 (No Poverty): Reached 1,836,522 smallholder farmers, improving their livelihoodsband economic stability

- SDG 2 (Zero Hunger): Supported the production of 2,695,235 tons of food per year, enhancing food security in target regions

- SDG 8 (Decent Work and Economic Growth): Facilitated the cultivation of 1,834,570 hectares of land, promoting agricultural productivity and economic development

These metrics demonstrate the tangible impact of our investments on poverty reduction, food security, and economic growth. By supporting smallholder farmers, increasing food production, and expanding cultivated land, AgriFI is making significant strides in fostering sustainable agricultural development and improving rural livelihoods across our target regions.

Leverage

AgriFI’s leverage ratio for investments in 2024 of 3.05X demonstrates our role as a catalyst for broader financial engagement in the sector. +37% of the amount mobilized have been invested by DFIs.

Our mission to accelerate access to finance for smallholder farmers and agribusiness MSMEs is clearly shown through the diversity of our 2024 investments and our dedication to comprehensive solutions for agricultural challenges in developing markets.

3.05X

Laverage ratio

37%

of the amount mobilized invested by DFIs factor

Organic Farming and Export Markets: Opportunities for African Farmers

The growing global demand for organic products provides African farmers with access to premium markets, enabling them to earn higher incomes while adopting environmentally sustainable practices. Moreover, by avoiding synthetic fertilizers and pesticides, organic practices improve soil health, conserve biodiversity, and enhance climate resilience. Organic farming not only addresses environmental challenges such as soil degradation and deforestation but also creates economic opportunities by connecting smallholders farmers to lucrative export markets. Certified organic products often fetch premium prices, allowing farmers to reinvest in their operations and improve their livelihoods.

Cajou Espoir’s Beekeeping Initiative in Togo - Technical Assistance

Cajou Espoir is Togo’s leading processor and exporter of organic and Fairtrade-certified cashews, supporting over 1,500 smallholder farmers and creating 700 jobs. The company processes 10% of Togo’s annual cashew production, promoting organic farming practices and sustainability. In 2023, AgriFI invested EUR 3 million to enhance Cajou Espoir’s processing capacity, automate operations, and expand farmer outreach.

However, Cajou Espoir faced challenges related to lower cashew yields due to climate change and rising raw cashew nut prices. To address some of these issues, Cajou Espoir decided to instal beehives to increase the yields of the cashew nut trees in the most sustainable way. EDFI Management Company partnered with COLEAD to provide technical assistance focused on apiculture (beekeeping) capacity building of the company.

The technical assistance aims :

- To boost yields: Enhanced pollination efficiency through beekeeping is expected to increase cashew yields at both Cajou Espoir as well as the neighbouring smallholder farmers plantations.

- To diversify income streams: Cajou Espoir aims to market the honey and honey products on the local and/or international markets.

- And it promotes sustainability: Beekeeping supports biodiversity conservation while strengthening resilience against climate shocks.

Climate Change impact to Agriculture

Climate change poses a significant threat to agriculture in countries where AgriFI invests, with severe droughts and floods becoming increasingly frequent and intense. These extreme weather events have devastating impacts on crop yields, food security, and rural livelihoods.

In early 2024, southern Africa experienced one of the most

severe droughts in recent history. The prolonged dry spell scorched crops and threatened food security for millions. February 2024 was the driest February in 40 years for parts of Zambia, Zimbabwe, southeastern Angola, and northern Botswana. Zambia declared a state of disaster in February 2024 due to an El Niño-induced drought during the 2023–2024 agricultural season.

The drought affected 84 of the country’s 116 districts, with maize production—the country’s staple crop—declining by 53%, making it the lowest output in five years. Approximately 43% of cultivated land was impacted, leaving many farmers struggling to sustain their livelihoods. In Zambia, maize crops withered on 1 million hectares—almost half of the country’s maize-growing area.

Conversely, West and Central Africa faced catastrophic floods in late 2024, affecting 16 countries. The floods resulted in the destruction of 3.9 million hectares of cropland across eight countries, significant food loss in Nigeria that could have fed 8.5 million people for six months, disruption of livelihoods, destruction of productive assets, and critical infrastructure damage.

Climate change is one of the most pressing challenges for agriculture, particularly in regions like East Africa, where livelihoods are heavily dependent on rain-fed farming. Rising temperatures, unpredictable rainfall patterns, prolonged droughts, and extreme weather events such as floods are threatening food production and rural incomes. Tanzania experienced a severe drought in April 2024, leading to massive crop failures and livestock losses. This was followed by extreme rainfall that caused widespread flooding, decimating infrastructure and contaminating water supplies. These events disrupted food production and livelihoods, underscoring the vulnerability of rural communities to erratic weather patterns.

The dual threats of droughts and floods highlight the urgent need for climate-resilient agricultural systems that can withstand these shocks while ensuring food security and sustainable livelihoods.

EA Foods Limited – Building Resilience Through Innovation and Sustainability

EA Foods Limited in Tanzania is a tech-enabled aggregator and distributor of fresh produce that is working to address climate challenges through innovative solutions. By connecting smallholder farmers to urban markets via its integrated farm-to market platform, EA Foods reduces post-harvest losses and strengthens the resilience of its supply chain.

Key Achievements:

- Climate-Smart Practices: EA Foods trains farmers on climate-resilient agricultural techniques such as crop rotation, intercropping, and the use of drought-resistant seeds.

- Reduced Post-Harvest Losses: The company’s efficient logistics system has reduced post-harvest losses from 40% to just 5%, ensuring more food reaches consumers.

- Market Access: By eliminating intermediaries, EA Foods provides better prices for farmers while improving food security in urban areas.

- Catalytic Investment: AgriFI’s EUR 1.86 million investment in 2024 enabled EA Foods to expand operations, acquire additional trucks and machinery, and directly source from more farmers across Tanzania.

- The company has a current network of 2,600 farmers which ensure more than 2,600 ha of food production..

Impact:

- Over the upcoming 5 to 7 years, more than 21,000 smallholder farmers will benefit from increased incomes and customised training on best practices for cultivation and harvest

- EA Foods is expected to enhance the sustainable, production of food and impact additional 22000 ha of land which will be cultivated and managed in line with best environmental and social practices

AgriFI plays a critical role in fostering climate-resilient agriculture by

- Investing in Climate-Smart Solutions: Supporting companies like EA Foods and Cajou Espoir that implement innovative practices to adapt to climate change.

- Providing Technical Assistance: Offering expertise to help companies adopt sustainable practices such as apiculture or reduce post-harvest losses.

- Catalysing Additional Funding: By Leveraging its investments to attract co-financing from other development finance institutions (including BIO) and private investors.

AgriFi investment in 2024 in EA Foods was in local currency which reduces exchange rate risk, aligns debt with local revenues, makes repayment more predictable and builds resilience. By supporting initiatives that combine technological innovation with sustainable practices, AgriFI is helping farmers adapt to a changing climate while enhancing food security and rural livelihoods. These investments demonstrate how targeted support can transform challenges into opportunities for growth and resilience in agriculture.

The Missing Middle in Agricultural Finance - Microfinance

Small and medium-sized enterprises (SMEs) are sometimes too large for traditional microfinance but too small or risky for commercial banks. By leveraging their deep understanding of local markets and rural economies, Microfinance institutions (MFIs) and local banks provide financial solutions that empower smallholder farmers and rural agribusinesses to thrive. Specialized MFIs and local banks willing to further go agri are critical players in addressing the “missing middle” of agricultural financing.

The “missing middle” represents a significant challenge in developing regions, where smallholder farmers and agri-SMEs often lack access to affordable financial products. These businesses are vital to food production, employment, and rural development but remain underserved by traditional financial institutions due to:

- Perceived high risks associated with agriculture,

- Limited collateral or credit history

- Small loan sizes that are less attractive to commercial banks

MFIs and local banks bridge this gap by offering diversified financial products, such as small loans, leasing options, savings and insurance, tailored to the specific needs of agricultural clients. Their proximity to rural communities allows them to assess risks more effectively and build trust with borrowers. In 2024, AgriFI supported Financial Intermediaries (FI) in various ways. This includes equity fund raising in Zambia, fostering agri leasing in Sri Lanka and supporting the diversification of the agriculture sector in Malawi by supporting a leading bank.

AMZ - Agora Microfinance Zambia

Agora Microfinance Zambia (AMZ) is a prime example of how microfinance can transform rural agriculture. Operating across Zambia’s 10 provinces, AMZ serves over 150,000 clients, primarily smallholder farmers and small traders in underserved areas.

Key Achievements:

- Tailored Financial Products: AMZ provides small loans, mobile money services, and leasing options designed for rural farmers.

- Impact on Farmers: An impressive 94% of surveyed customers reported increased income, with 82% accessing loans for the first time.

- Catalytic Investment: AgriFI’s taking a sizeable minority stake in AMZ (EUR 1.77 million equity investment) in 2024 will help expand its reach, diversify its offerings, and upgrade its technology infrastructure.

Impact:

- Over 34,000 smallholder farmers will benefit from access to credit

- More than 36,000 ha of rural land will be farmed and used more sustainably due to increased access to financial and responsible field practices.

Sarvodaya Development Finance (SDF), Sri Lanka

Sarvodaya Development Finance PLC (SDF) illustrates the transformative role of local financial intermediaries in agricultural finance. As the economic arm of the Sarvodaya Movement in Sri Lanka, SDF focuses on financial inclusion including rural communities.

Key Achievements:

- Agricultural Leasing: SDF’s leasing product allows farmers to access essential machinery like tractors and harvesters.

- Rural Focus: Over 78% of SDF’s clients reside outside urban centres, with agriculture representing more than a third of portfolio.

- Catalytic Investment: AgriFI’s EUR 2.83 million senior debt investment in 2024 will enable SDF to expand its agricultural portfolio and reach more underserved farmers.

Impact:

- Over 2900 smallholder farmers will benefit from access to credit

- More than 5900 ha of land will be cultivated under sustainable field practices

SDF’s support has helped farmers increase yields, reduce post-harvest losses, and improve their incomes. AgriFI is the first international investor supporting the company, which is expected to attract other investors. The transaction was closed over an exceptional period of political and economic turmoil.

By working closely with MFIs and local banks, AgriFI helps address systemic challenges in agricultural finance. These partnerships enable smallholder farmers to access the tools they need to build resilience against climate shocks, increase productivity, and contribute to food security across developing regions.

Through investments like these, AgriFI demonstrates how microfinance can be a powerful catalyst for agricultural transformation—bridging financing gaps while fostering inclusive growth in rural communities worldwide.

Looking Ahead

AgriFI’s strategy for the future builds on its core mission of fostering sustainable agricultural development while embracing new opportunities for diversification and innovation. In 2025, we will focus on three key areas of growth:

- Scaling Climate-Resilient Agriculture: AgriFI will prioritize investments that enable smallholder farmers and agribusinesses to adapt to climate shocks. Projects such as EA Foods Limited’s post-harvest loss reduction strategies and Cajou Espoir’s apiculture initiatives demonstrate how innovative solutions can build resilience while improving livelihoods.

- Strengthening Value Chains: By supporting processing facilities (e.g., Zanj Spices and gebana) and market linkages, AgriFI will help farmers capture more value from their produce while fostering sustainable supply chains.

- Diversification into New Sectors: Building on its success in agriculture, AgriFI aims to expand under well-defined conditions into adjacent sectors such as forestry, agri-tech, and aquaculture. Investments in forestry projects will support carbon sequestration and biodiversity conservation, while agri-tech innovations like precision farming and smart irrigation systems will enhance productivity and resource efficiency.

While addressing global agricultural challenges we will continue to mobilize additional funding and technical expertise and drive inclusive growth across developing regions.

As we look toward the future, our vision is rooted in driving long-term transformation in the agricultural sector with focus on innovation, diversification, and sustainability. By scaling successful models, exploring new sectors like forestry and agri-tech, and strengthening value chains, AgriFI aims together with its partners, tackle emerging challenges while creating opportunities for inclusive growth across developing regions.

Contact Details

EDFI Management company

Rue du Trône 4,

1000 Brussels

info@edfimc.eu

www.edfimc.eu

AgriFI Annual Report 2024

Staying on Course in Stormy Weather